In December 2022, our Consulting Managers Margarita Svarceva and Peter Hays attended the GIANT Health Conference in London. The two days were filled with engaging workshops, panels, and exhibitors. The conference was attended by many key stakeholders in the healthcare and innovation ecosphere including medical innovation start-ups, health and pharmaceutical companies, investors and regulators. Attendees were a mix of British, European and North American companies. We were immersed into the world of healthcare innovation, and we saw several key trends emerging. GIANT stands for ‘Global Innovation and New Technology’ show. The yearly event brings together individuals and companies in the healthcare innovation space through a 2-day exposition with 4 thematic presentation programmes. This year’s presentations were focused on Digital Pharma, the Future of Hospitals, Mental HealthTech and the new Integrated Care Structure in the NHS. The event aims to improve health and well-being of people around the world by facilitating healthcare innovation and supporting health-tech entrepreneurs and investors. The types of exhibitors present at GIANT Health 2022 can be segmented into the following categories, albeit not exclusively:

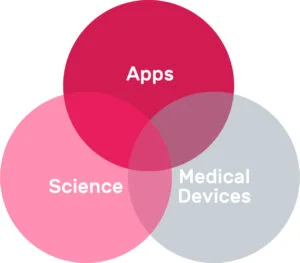

Many companies are naturally offering a product or service through an app which can be easily accessed by the user or patient on their phone at any moment. A large majority were offering an app or included an app as part of their offering, either:

Some of the start-ups offered more traditional medical devices independent of an app. These innovations provide either an improvement to healthcare infrastructure or a direct solution for a patient condition. This includes small-scale point-of-care testing, which are small devices that can provide various on the spot blood tests with results being available instantly. It also includes start-ups which had created a company around a new scientific approach or method. One example includes a company using genetic materials to identify bespoke treatment approaches for Oncology patients to improve outcomes. The companies that exhibited at GIANT Health in 2022 were on a spectrum of maturity. Some were newly created start-ups and still in development phases, while others were more mature companies with demonstrable success in one country looking to expand to new markets to find new patients or customers. A large proportion of companies were in-between, with a well-established offering but looking for investment and further support.

S&S sat in on various panels and industry discussions about the current challenges for MedTech and digital therapy companies and in particular the challenges new health technology companies have to navigate. We took the following lessons with us.

Across countries, but particularly in the UK, we are currently seeing an under-funded and under-staffed healthcare system. One remedy would be new technologies and innovation to supplement care with digital systems which provide support, monitoring and/or treatment to patients who are unable to access other forms of care. The challenge, however, is that while funding is readily made available for research and development of innovative technologies, this does not extend to implementation in the UK. This results in a large pocket of innovation, which is followed by brain drain, in which start-ups are seeking to launch somewhere they will receive more support. Consequently, the UK is losing out on many of the good ideas it helped foster.

Most innovative digital therapies have a clear cost saving, process improvement or outcome improvement evidenced in their design. However, the current reimbursement frameworks treat these as a medical device rather than a treatment which comes with challenging regulatory hurdles. These start-ups are required to fulfil extensive evidence-based reimbursement criteria which can be challenging for many start-ups. Randomised control trials are expensive to conduct. Real-world data, which is collected from real patients or users as they engage with the digital treatment, are not always accepted, or are accepted with strict criteria. As a result, many digital therapies, which could complement the healthcare service, struggle to gain any reimbursement. On top of that, the NHS is a highly fragmented organisation with 42 ‘Integrated Care Systems’ (ICS). Once a new digital tool has enough evidence to even be reimbursed, they must deal with each ICS on an individual basis, which can be resource-draining for small start-ups. In reality, digital therapies are very scalable and easy to implement elsewhere once they are up and running – it is difficult to understand why they need to jump through the same hurdles again. A more open-minded NHS could integrate digital therapies to provide care to patients struggling to gain access to healthcare professionals.

Tech tools and innovative platforms have been used in every industry for decades now. However, the healthcare system remains very slow at adopting organisational or monitoring technology which can lessen the current burden on care services. While there is constant news and updates about new ways technology is being used to make healthcare more accessible and equitable, as the GIANT Health London 2022 conference demonstrates, the existing systems are not realising the value that this technology brings. Healthcare has been the slowest at incorporating simple organisational tools into its daily function (e.g. online booking systems), hence advanced digital therapies such as specialised remote monitoring platforms, apps which deliver anxiety-reducing support or platforms which help track patients with chronic conditions, have not been incorporated into the NHS. The sheer low level of technological solutions available to patients, points to a clear lack of understanding on the value these could bring. Overall, most healthcare systems are not designed to be open to digital therapies and MedTech, and fail to take into account how their approach needs to be adjusted to bring them into the fold.

Sector & Segment has extensive experience working with Medtech companies to tackle the challenges we identify above. Challenges of funding, reimbursement and awareness are key pain points faced by most companies in the healthcare space. We have successfully worked with MedTech clients to identify whether public reimbursement is the best solution or if direct-to-consumer channels are more lucrative; whether a product is not being used due to awareness or due to negative perceptions; whether new market entry is an attractive strategy. Our experts could help you: