In the past 10 years, the Medical Nutrition (“MN”) sector has shown significant evolution of its sales and marketing approach. For a long time, this sector targeted dietitian teams based in hospitals with relatively simple product lines segmented by age groups (paediatric vs. adult), product formats (enteral vs. sip) and flavours.

But the context changed as hospital budget constraints driven by national government cuts put pressure on the costs associated with MN, which has often been regarded by payers and healthcare professionals (“HCPs”) as a mere commodity.

In response, MN manufacturers started adopting a different go-to-market approach, focusing on specific therapeutic areas and bringing some disease-specific innovations to the market in order to fight back commoditisation. Disease-specific MN products are intended to be so uniquely suited for a specific patient group that they can justify a premium price and still obtain better payers’ subsidies, provided they are supported by enough scientific and health-economic evidence.

By offering something uniquely suited to a disease rather than a generic nutritional solution, Medical Nutrition Companies hope to gain broader hospital recognition (including from specialist doctors) instead of being systematically referred to the “Dieticians’ floor” or “the kitchen”. This subsequently increases their chances of becoming core components of treatment protocols alongside pharmaceutical drugs.

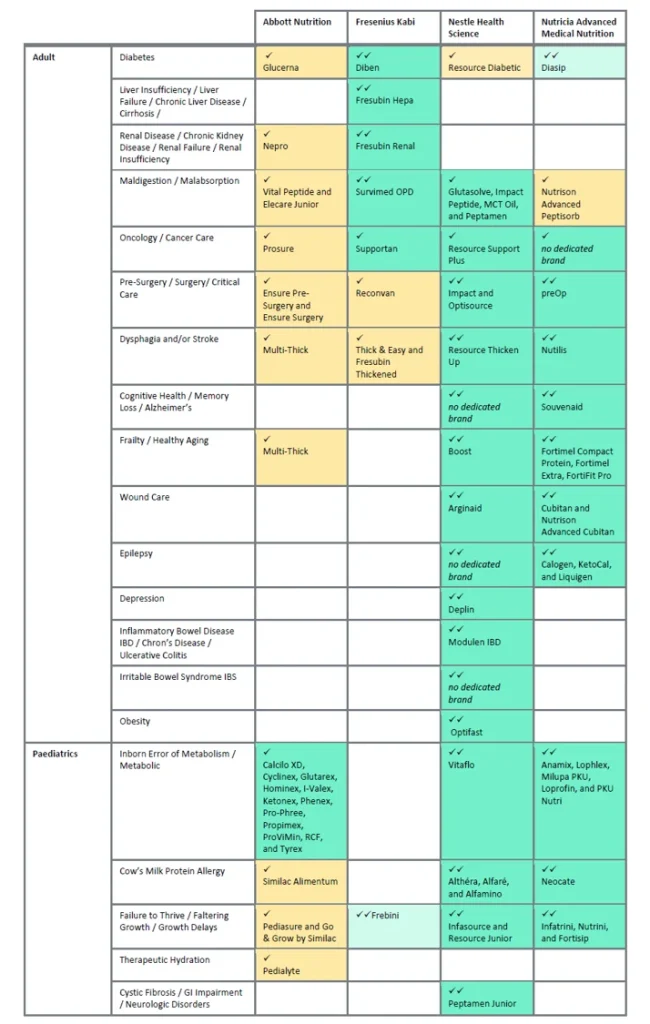

By analysing the way the top 4 global MN manufacturers present their product portfolio on their global websites we can see a concerted shift towards a “disease-specific” model (see table below).

Among these companies, Nestle Health Science and Nutricia Advanced Medical Nutrition appear to be leading the shift toward a disease-specific approach; they are broadly spread across numerous adult and paediatric pathologies.

Fresenius seems to have opted for a narrower pathology focus, maintaining a more holistic positioning of MN, except for a few “star” therapeutic areas.

Finally, Abbott has maintained a more traditional segmentation by age group, which leads to a list of products which offer minimal mention on the underlying pathologies they target. This positioning is interestingly in exact contrast with Nestle’s and Nutricia’s although they cover a similar breadth of medical conditions.

Our analysis shows that none of these companies rely today on a broad malnutrition concept suitable for undefined sets of therapeutic areas. This exposes the (perceived) necessity among industry leaders of increased specialisation to cope with hospital budget pressures.

The shift toward a disease-specific positioning of MN has many consequences on the way marketing and sales teams of MN companies operate.

First, marketers and sales representatives of MN companies should align their internal structure to the therapeutic areas they intend to play in. In sales, medical expertise becomes as critical as nutritional knowledge and commercial flair. This most likely entails hiring new talents with a pharma background and/or a medical degree. The cost of the sales force may subsequently increase to align with the pharmaceutical industry.

Second, it requires the addition of Medical Affairs team members dedicated to proving the health-economic benefits of an innovative disease-specific product vs. a more generic one; this is because, nowadays, few medical products and solutions, as effective as they may be, will get adopted by payers and HCPs without solid health-economic evidence proving better or quicker therapeutic outcomes and shorter hospital stays.

Finally, it adds layers of complexity to marketing teams’ portfolio management strategy at the country level. On one hand, they need to continue to serve their current markets, and on the other, they are expected to prioritise the adoption of therapeutic areas based on the incidence-based opportunity these represent. As a result, it wouldn’t be a surprise if marketing managers struggle to decide how to update their product mix without putting at risk the health of their P&L.

These are some of the questions that may arise in these marketing organisations:

In fact, there is often a fear that shifting the focus onto a specific pathology or new product can undermine the many efforts over the years by sales and marketing teams to develop their existing portfolio and sales.

But standing still is never a solution so how to go about it?

Sector & Segment can help MN companies to navigate through these complex issues and come up with solutions that measure the pros and cons of different portfolio “scenarios”.

Over the years, our team has conducted 80 strategic projects in 25 countries across 12 therapeutic areas of Specialist Nutrition, helping its clients to develop product and disease specific propositions.

For more information, please contact me at marie.maigre@sectorandsegment.com